Credit Underwriter

Credit Underwriter

£30k to £35k depending upon experience

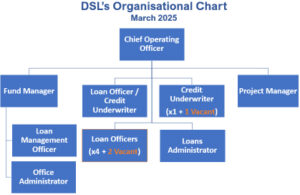

Reporting To:Chief Operating Officer

DSL Business Finance is Scotland’s leading not-for-profit lender, providing vital loan finance to SMEs. Over the past five years, we have delivered over £19 million in loans to 637 businesses, creating and sustaining 3,793 jobs across Scotland.

We provide and manage a range of loan funds, including microfinance loans of up to £25,000 and smaller loans between £25,000 and £100,000 to support start-up, early-stage, and growing businesses across Scotland, offering financial support at key stages of their development. Delivering these loans successfully requires a good understanding of loan products, risk management, and the needs of businesses at different stages of growth.

Our objectives are to create opportunities for enterprise, grow existing businesses, create job, and contribute to the long-term sustainability of local communities across Scotland

The Credit Underwriter is responsible for reviewing and assessing loan applications submitted by the Loan Officer team, and ensuring applications received comply with scheme rules and are within policy when making credit decisions.

The post holder will ensure all internal and external risk/compliance protocols are followed and maintained, preparing accurate and concise assessments that provide a clear indication of the decision-making process to achieve a ‘right first time’ outcome.

Duties are determined by the Chief Operating Officer. There will be an annual appraisal with interim reviews of objectives as well as ongoing informal meetings as required in line with normal business practice. Priorities are set in line with business needs

Internal

| Chief Operating Officer, DSL Team | Assignment and progression of work. |

External

| Professionals, Business Advisers and Other funding organisations | Provision and exchange of information to promote the various loan funds. |

Essential

- Personally organised, diligent with an eye for attention to detail.

- An understanding of the SME market

- Strong analytical skills with ability to document findings and make recommendations.

- Excellent communicator both verbal and written.

- Ability to work independently and as part of a team being able to take initiative as circumstances require.

- Competent IT Skills.

Desirable

- Business Plan assessment skills

- Financial qualification/experience

- 3 year’s general business experience

- Minimum 2 years lending experience to SMEs

- Car owner/clean licence

- Experience of working as part of team in a fast-paced environment